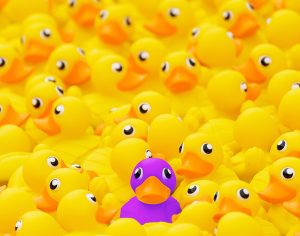

The media and other content sources play a critical role in sharing news and information – it’s something on which we all rely. But with the divergence of media across a host of channels, from print to TV, the internet to social media – as well as a host of self-promoting content creators – it has never been more important for audiences to be mindful of the authenticity, quality and accuracy of the information they consume. Here, the Managing Director of EweMove, Nick Neill, discusses the importance of cutting through the noise and hype of media.

The spoken and written word, now we’re in the internet and social media age, has never had such a significant – and widespread – impact on consumers’ trust, opinions and knowledge. In this context, the definition of ‘consumer’ is expanded, as media activity – especially in magazines and outlets that focus specifically on an industry trade – have a huge impact on perceptions and understanding, as well as a prospects’ willingness to invest in franchise opportunities.

Well researched or not, the information shared about a brand leads us to make assessments on matters. In some cases it can helps make decisions without doing primary research and may feed into discussions that could determine the success of a franchise opportunity. In the property industry in particular, cutting through media hype has never been more important.

We saw the media at large predict doom and gloom in the property sector at the end of Q4 heading into 2023. This was drawn from three key market events:

- Mortgage rates were increasing because of the Bank of England increasing bank base rates

- House prices were forecast to fall rapidly – some predictions suggesting by up to 35%

- House sales were forecast to decline by over 20%.

But if we break these points down and look at what history tells us, we can consider these market drivers more objectively.

The last time the property market seriously crashed was 2007/08. But even then, it did not come to a standstill. And following several peaks and troughs in the property market following that period, it has consistently levelled out at the ‘normal’ rate, which for many years means around 100,000 property sales transaction a month in the UK.

However, the press interpretation of a “collapsing market” was to measure this normal volume against the post pandemic peak over 214,540 sales which was totally unsustainable. The market was always going to return to its normal levels so there never was a ‘collapse’ in the market at all.

This time around in 2023, a respected newspaper outlet interpreted Nationwide’s predicted 5% property value decline in a headline-grabbing “10% decline” (over the next 2 years), rather than 5% a year. However, prices have in fact stabilised from their runaway growth rates of 2022. With no large-scale reductions evident, in fact it is more of a slowdown in the growth rate, rather than a mass reduction.

As a franchisor in the property industry, we ensure we educate our future and current franchisees to use data and facts that demonstrate what is really going on, rather than relying on headlines that grab attention to sell newspapers and make people tune in. After all, the truth is not always quite as sensational.

There is a phrase in sales, “Facts tell, stories sell” – meaning people naturally lean towards a good engaging story and are bored by dry statistics. So, the real skill in any business, in franchising and in property, is to sell our services through customer stories & testimonials, backed up with data and facts. Remaining truthful and honest without succumbing to sensationalist headlines is indeed a challenge in today’s saturated mediascape. But as a multi-award-winning, highly trusted brand, we think we have got the balance right.