There is comfort in the familiar and adventure in the unknown. Deciding whether to invest in a franchise that has household name recognition, or to put your money into a new and emerging competitor, is a big decision – and one not to be taken lightly.

Here, Cheryl White, founder of Apollo Care Franchising Ltd, debates the pros and cons of investing in elite franchises with instant brand recognition versus rising stars of the franchise scene:

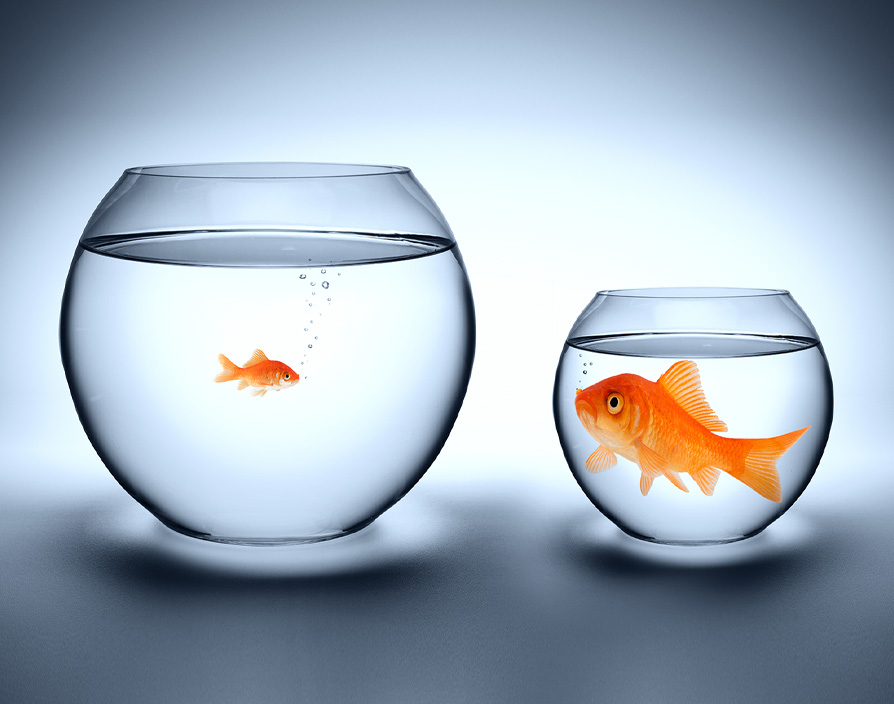

Do you want to swim in a large shoal, working as one towards a common goal, or to be a big fish in a smaller pond? Both options have their merits. There is certainly strength in numbers. You may thrive as part of a major franchise – particularly if you have previously worked in a corporate environment and feel a powerful need to replicate its hierarchical structure for reporting and accountability. However, the pay-off could be that you will feel like a number or a mere cog in the machine. Your queries may be directed to online FAQs or a chatbot support team that has been outsourced overseas.

Key decision and policy makers can be difficult to access and influence, with many gatekeepers guarding their time. Up-and-coming franchisors, however, tend to have an open-door policy with direct lines of communication to the founder and Chief Operating Officer. You may feel that you are more likely to achieve a return on your investment with a personal support team behind you – especially if you are new to the franchising world and want advice tailored to your unique circumstances.

Big-name franchises offer the security of tried and tested systems for success that thousands have walked before you. Smaller franchises allow you to be an influential figure in shaping what that roadmap looks like. If, for example, you crave the certainty of flatpack furniture and its prescriptive assembly instructions, a well-established franchise with a ‘business in a box’ ethos could be a great fit for you. For those who like to customise and influence their environment, embryonic franchises are more likely to satisfy those urges. The ‘butterfly effect’ is less keenly felt at this stage, compared with bigger franchises, where even a slight tweak to the operating manual impacts the working practices of hundreds – if not thousands – of franchisees.

Brand recognition is the biggest advantage of investing in a larger franchise. Customers know before your doors have even opened what your product or service looks like; how much it is likely to cost; and have an expectation of the level of customer satisfaction they are likely to experience. Conversely, emerging franchises must do the legwork of getting known – a process that can take time and requires dedicated, specialist support.

For new franchisees who want to hit the ground running – focusing their time and energies on staffing, training and embedding systems – brand recognition is a gift. However, it can also be a minefield… If that national or global brand becomes embroiled in negative press or, heaven forbid, is ‘cancelled’ in the court of public opinion, the tide can be difficult (if not impossible) to turn. Also, the cost for expensive marketing campaigns that require blanket national or global coverage will almost always be passed on to franchisees. Newer, more disruptive franchises can be more agile when reacting to – and capitalising on – emerging consumer trends. They often make better use of guerrilla and hyper-localised marketing techniques, without the layers of corporate approval.

For newer franchises, much of the UK and beyond is unchartered territory, with unclaimed regions galore. The right franchisee can put down roots and start working on their return on investment without a competitor franchisee encroaching upon their space. Larger franchises may have fewer opportunities, with lucrative territories being fought over. To the victor go the spoils, however, with risk-averse investors appreciating the security of being able to view a sales record from a proven ‘patch’.

Your appetite for risk, desire for autonomy and the level of personalised support you are likely to need are critical considerations when choosing between franchise offers. ‘Go big or go bust’ does not apply to this sector, where for every Goliath, there is a David waiting to succeed from a position of quiet strength.