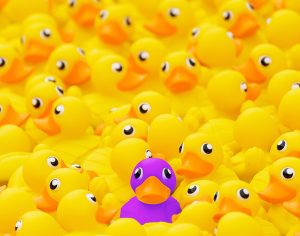

Diversification is spreading your risk across different types of investments. Markets can be volatile and unpredictable, so by diversifying your portfolio, you are protecting yourself from serious loss if one business faces unforeseen challenges. Having a diverse franchise portfolio can set you up for success.

Much like you keep a portfolio of different stocks to diversify your investments, as a franchisee, you stand to benefit from owning multiple franchises. It is very sensible to avoid putting all your eggs in one basket and invest in several different concepts in order to vary your portfolio. A diversified franchise portfolio can provide you with steady, predictable returns and scalability over time.

To grow your franchising portfolio, you do need to be strategic when choosing your concepts. Adding concepts in different industries will not only add further income and stabilise your portfolio but will also reduce volatility and risk. Having seen the disruption brought on by the pandemic, many people are wary to start a new business, but for those with an entrepreneurial mindset, now is the ideal time to diversify and grow your portfolio.

Sanjeev Sanghera, Co-Founder and Managing Director of Döner Shack, shares his five steps to diversify your franchise portfolio to achieve long-term success.

Spread your investments

Business ownership can be unpredictable. If all your investments are tied up in one brand you are baring yourself to greater risk, particularly if that brand then loses some of its value. If, however, you have a larger portfolio, you will face far less of a hit and could recover your losses through your other ventures. Diversification can help you remain competitive in more than one market, increasing the opportunities for greater return.

Decreases risk and instability

A key reason for diversifying is to reduce your overall risk. The more you spread your investments out, the less likely it is that one event, such as a pandemic or global recession, will adversely impact your whole franchise portfolio. Likewise, the volatility of a market is a key variable in the decision to make investments. For example, if a particular market has high volatility, your risk may increase but your opportunity for greater returns will also rise.

Dynamic brands

Skilful franchisees are drawn to concepts that are forward-thinking and profitable. As proven by the pandemic, brands that are agile will be long-lasting and will continue to be dependable revenue streams in the future. This is a mark of a good investment and should be considered while researching concepts to add to your portfolio. For example, fast food concepts have been gaining traction for years, but with consumers now leaning into brands that are socially and environmentally friendly, fast-casual restaurants are able to meet this demand and become a more appealing choice for many.

Complementary concepts

There are some franchise brands that naturally complement each other, and though it might be alluring to invest in a number of similar concepts, it is, however, important to make sure they are suitably differentiated, and not direct competitors. For example, within the food and beverage sector, it would seem right for a fast-food owner to diversify with a fast-casual restaurant business, developing crossover sales and building relationships with customers through two different businesses.

Choosing to buy multi units or multi brands

When diversifying your portfolio, you need to decide when expanding your franchises whether to buy multiple units of the same franchise or invest in another or several more brands. There are obvious benefits to buying multiple units within the same brand as you already know the system, have a relationship with the franchisor and know the product or service you are selling. Investing in different franchise brands, however, may take more work in the initial stages as you have to learn new systems, but it may offer opportunities where your portfolio could be lacking, and at low risk to you.

“The key to intelligent investing is diversification – it’s all about minimising risk when investing capital,” says multi-brand and multi-unit franchisee and CEO of Döner Shack, Suj Legha. “Having been involved in franchising for 20+ years, I know the industry well and believe there are plenty of benefits of diversification in franchise ownership. It allows for a certain amount of high-return investments by offsetting possible risks through more stable alternatives.

“From my experience as a franchisee who has had successful businesses, including ActionCoach and Papa Johns, I’ve always felt that entrepreneurial pull to open another business. Having a diversified franchise portfolio is an attractive option that can lead to success if you have solid foundations in place and a good track record to secure funding and approvals by franchises. I am always looking for new opportunities, but for the moment I’m 100% committed and focused on scaling Döner Shack as we have an aggressive growth plan this year to open new sites across the UK. The diversification is more likely to come from different markets as opposed to different franchise brands for now, as we grow in the UK and take our first steps into the USA,” commented Suj.

As the events of 2020 showed us, anything can happen, and sometimes that can impact a business’s source of income. So, for those who are looking to diversify their franchise portfolio, now might be the ideal time to make the jump. A franchising portfolio that combines your aspirations with long-term concepts is central to successful diversification and will help you achieve lasting success, as well as be a more engaged franchisee. It will also provide you with the opportunity to apply your business acumen, market knowledge and creative energy to another brand. So, putting your money into lots of different investment baskets can only reduce risk up to a point and not remove it entirely.